The Single Strategy To Use For Paul B Insurance Medicare Agent Huntington

Table of ContentsRumored Buzz on Paul B Insurance Medicare Advantage Plans HuntingtonGetting My Paul B Insurance Medicare Supplement Agent Huntington To WorkThe Definitive Guide for Paul B Insurance Medicare Insurance Program HuntingtonPaul B Insurance Medicare Health Advantage Huntington Things To Know Before You BuyWhat Does Paul B Insurance Medicare Insurance Program Huntington Mean?

A: Initial Medicare, likewise referred to as conventional Medicare, consists of Component An and Component B. It permits beneficiaries to head to any kind of physician or health center that accepts Medicare, anywhere in the USA. Medicare will pay its share of the fee for each solution it covers. You pay the rest, unless you have extra insurance that covers those expenses.You are covered for up to 100 days each advantage duration if you qualify for coverage.: Medicare covers services in your house if you are homebound and also require knowledgeable care.

: This is care you may elect to get if a company identifies you are terminally ill (paul b insurance medicare agency huntington). You are covered for as long as your provider licenses you require treatment.

Lots of people do not pay a month-to-month Component A premium since they or a spouse have 40 or more quarters of Medicare-covered employment (paul b insurance medicare agency huntington). In 2023, if a person has less than 30 quarters of Medicare-covered work the Component A costs is $506 each month. If a person has 30 to 39 quarters of Medicare-covered work, the Component A premium is $278 each month.

The 7-Second Trick For Paul B Insurance Medicare Agency Huntington

Long lasting medical devices (DME): This is devices that serves a clinical function, has the ability to stand up to repeated use, and also is proper for use in the residence. Instances include walkers, wheelchairs, and oxygen storage tanks. You might acquire or rent DME from a Medicare-approved distributor after your carrier licenses you require it.

Therapy services: These are outpatient physical, speech, and also work therapy services offered by a Medicare-certified specialist. Chiropractic care when control of the back is clinically needed to deal with a subluxation of the spinal column (when one or even more of the bones of the spine relocation out of position).

Things about Paul B Insurance Medicare Advantage Plans Huntington

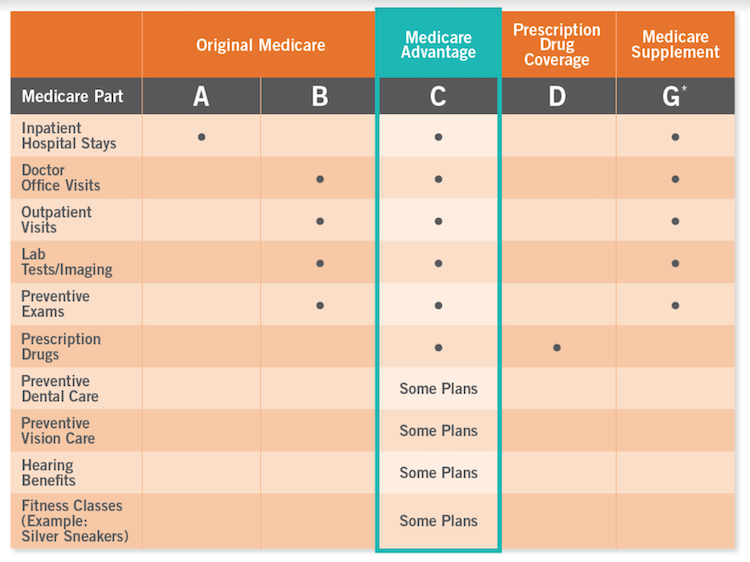

Several type of Medicare Advantage Plans are offered. You might pay a monthly premium for this protection, in enhancement to your Part B costs. If you sign up with a Medicare Advantage Strategy, you will certainly not use the red, white, as well as blue Medicare card when you go to the doctor or health center.

These plans may read the article cover superior deductibles, coinsurance, and copayments and also might also cover healthcare costs that Medicare does not cover at all, like care got when taking a trip abroad. Bear In Mind, Medicare Supplement Program only deal with Original Medicare. If you have a Medicare Benefit Plan, you can deny a site Medicare Supplement Plan.

Each policy uses a different collection of standard advantages, implying that policies with the very same letter name offer the very same benefits. Premiums can vary from firm to firm. Look into our New to Medicare web page. There you'll discover more details regarding ways to get ready for Medicare, when and exactly how you require to enlist, what to do if you intend on functioning beyond age 65, choices to supplement Medicare, as well as resources for more info and support.

Unknown Facts About Paul B Insurance Medicare Part D Huntington

It is occasionally called Typical Medicare or Fee-for-Service (FFS) Medicare. Under Original Medicare, the federal government pays directly for the wellness care services you get.

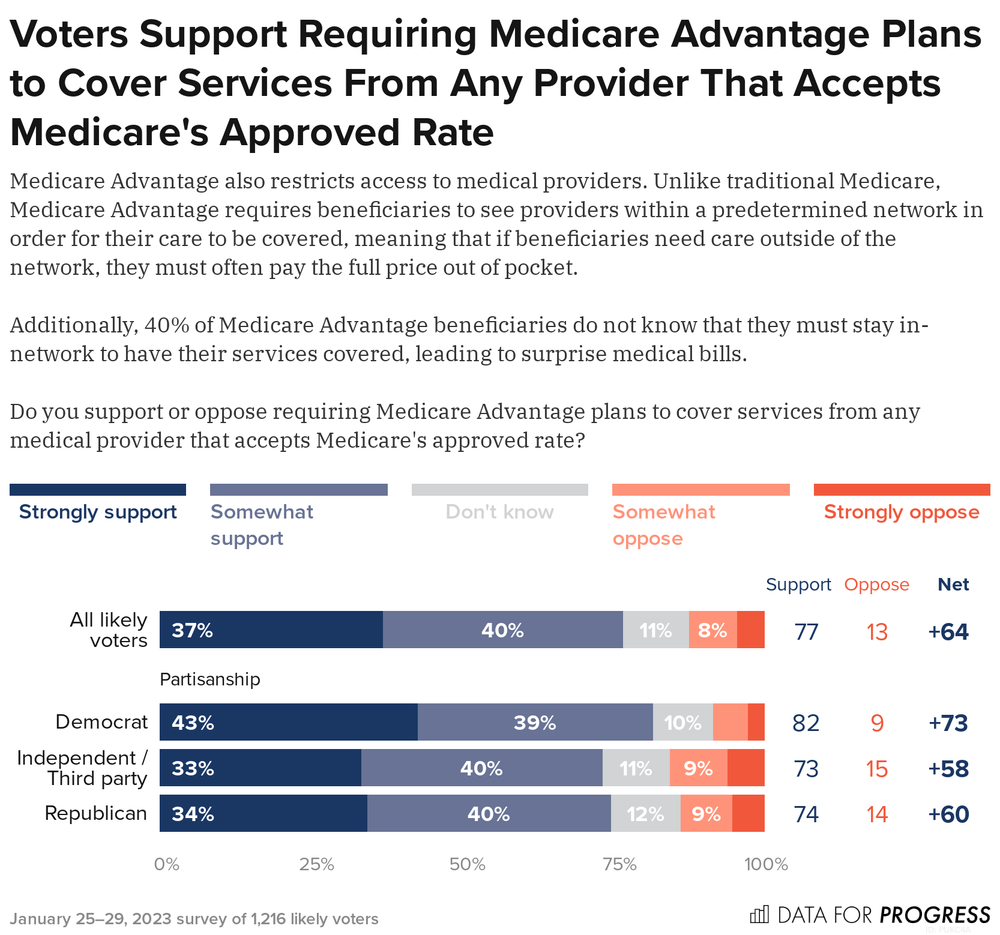

It is essential to comprehend your Medicare coverage options and also to choose your coverage meticulously. Just how you select to get your benefits and also who you obtain them from can affect your out-of-pocket expenses and also where you can obtain your care. For instance, in Original Medicare, you are covered to visit almost all medical professionals as well as healthcare facilities in the nation.

Medicare Advantage Plans can additionally give additional benefits that Original Medicare does not cover, such as routine vision or oral treatment.

These strategies are provided by insurance companies, not the federal government., you need to also get Medicare Parts An as well as B. You can check out the graph above for a refresher course on eligibility. Medicare Benefit strategies likewise have particular solution locations they can provide coverage in. These service locations are certified by the state and also approved by Medicare.

Some Known Questions About Paul B Insurance Medicare Agent Huntington.

A lot of insurance strategies have a web site where you can inspect if your doctors are in-network. Keep this number in mind while reviewing your different plan alternatives.